As January 2026 begins, the IRS has confirmed a one-time $2,000 direct deposit aimed at providing short-term financial relief to American households. With rising costs for groceries, utilities, and post-holiday expenses, this payment offers a timely boost to eligible recipients. Unlike standard tax refunds, this deposit is not linked to tax liability, does not require repayment, and is designed to deliver immediate financial support.

Purpose and Scope of the $2,000 IRS Payment

The $2,000 payment is intended as a temporary financial buffer for low- and moderate-income households. Federal officials emphasize that it is a one-time relief measure, helping cover essential expenses such as rent, groceries, transportation, and healthcare during the early months of the year. While reminiscent of prior stimulus initiatives, this deposit is structured to reach recipients efficiently using existing IRS data, avoiding the need for new applications or complex eligibility reviews.

Economist Priya Kapoor notes, “Early-year financial strain is common for many families. A direct deposit of this size provides immediate breathing room, helping households stabilize budgets without waiting for routine tax refunds.”

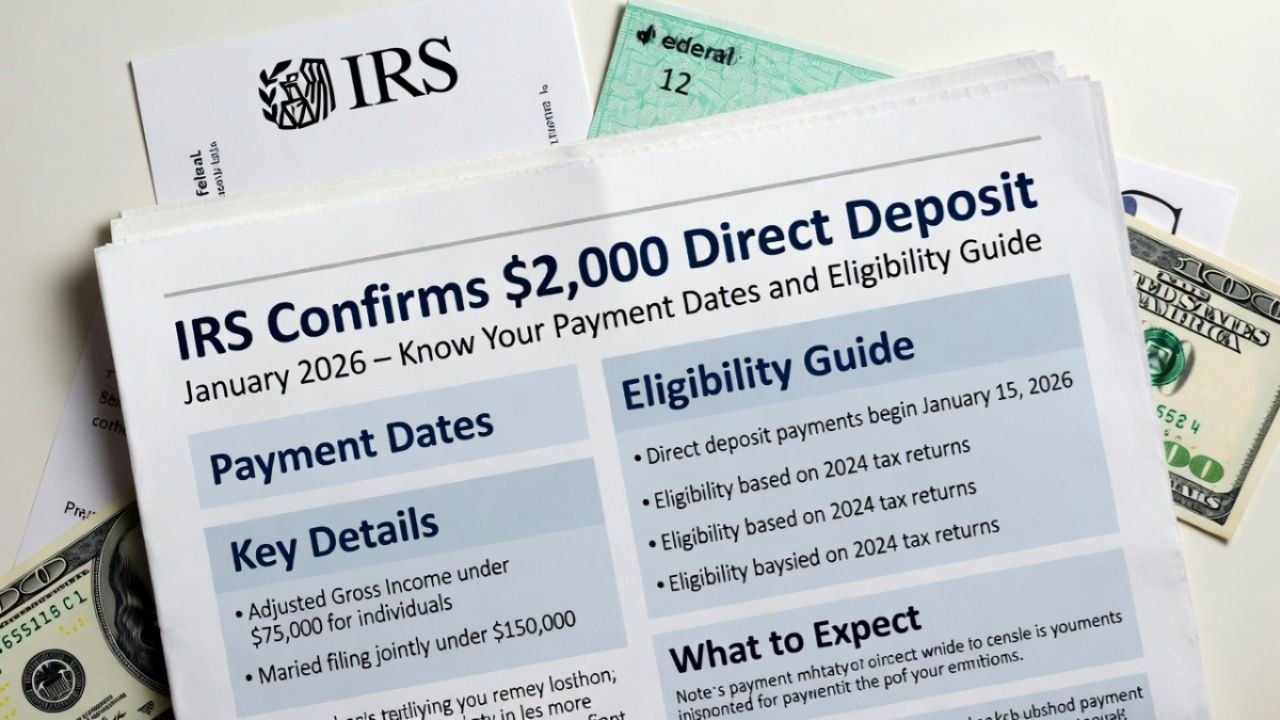

Eligibility Criteria and Income Limits

Eligibility for the January 2026 $2,000 deposit primarily depends on income and filing status:

- Single Filers: Annual earnings up to $75,000 typically qualify for the full payment.

- Married Filing Jointly: Combined earnings up to $150,000 may receive the full amount.

- Partial Payments: Households slightly above these thresholds may receive reduced deposits.

Additional requirements include having a valid Social Security number and meeting basic U.S. residency rules. Dependents listed on tax returns can also influence total benefits, ensuring that larger families receive proportional support.

Policy analyst Anjali Mehta explains, “The IRS leverages recent tax filings to determine eligibility automatically, ensuring that payments reach those who need them most without requiring separate applications.”

Payment Schedule and Distribution Process

The IRS will release the $2,000 payments in multiple waves throughout January 2026:

- Direct Deposits: Prioritized for recipients with bank accounts on file. Funds typically appear in accounts within days of release.

- Paper Checks: Sent by mail to individuals without direct deposit information, with delivery times naturally longer.

IRS spokesperson Rajesh Iyer highlights that “phased releases reduce processing errors and prevent system overload, ensuring accurate distribution to millions of households.”

Ensuring Timely Receipt

To avoid delays, taxpayers should verify that their banking and personal information is current with the IRS. Updates to bank accounts or mailing addresses should be submitted promptly through official IRS channels. Individuals who do not normally file tax returns may need to provide details through designated non-filer tools to ensure inclusion.

Monitoring official IRS announcements is crucial. Social media speculation and third-party sources can be misleading, potentially delaying receipt if incorrect instructions are followed. Accurate records and adherence to official guidance are essential for timely payment.

Comparisons to Past Federal Payments

While reminiscent of pandemic-era stimulus checks, the January 2026 $2,000 deposit differs in key ways:

- It uses existing IRS data for automatic distribution.

- It is designed strictly as short-term relief, not a recurring entitlement.

- It is unrelated to tax obligations, requiring no repayment.

Lessons from prior payments underscore the importance of maintaining current records and enrolling in direct deposit to maximize speed and accuracy.

Financial Impact and Public Reception

For eligible households, the $2,000 deposit provides meaningful short-term relief, helping cover essentials or reduce high-interest debt accumulated over financially challenging months. While one-time payments do not resolve structural economic pressures, they can ease immediate burdens.

Public response has been largely positive, with recipients sharing confirmations of deposits and discussing strategies for utilizing the funds. Analysts predict that similarly targeted relief measures may continue in the future during periods of economic strain, provided they are carefully structured to support those in need without creating long-term fiscal obligations.

Final Thoughts

The January 2026 $2,000 IRS direct deposit represents a focused, short-term effort to support households facing early-year financial challenges. Ensuring eligibility, verifying personal information, and following official IRS guidance are key to receiving funds promptly. While not a permanent solution, this initiative reflects a practical approach to targeted financial relief in 2026.

Disclaimer: This article is for informational purposes only. It reflects publicly circulating IRS reports as of January 2026 and does not constitute financial, tax, or legal advice. Policies and payment programs are subject to change. Readers should verify all information through official IRS communications and avoid sharing personal banking details in response to unsolicited messages.